| Products | |

| Membrane Roofing Systems TPO PVC EPDM SBS APP BUR Liquid Applied | Roofing Components Insulation and Cover Boards Adhesives, Cements and Primers Specialty Roofing Products Fasteners and Plates Coatings |

For Professionals

Building Owners

Building Owner Resources

Preferred Accounts

Sustainability Solutions

Guarantees and Roof Maintenance

Find a Contractor

Contractors

Contractor Resources

JM Peak Advantage Contractor Program

Roofing Institute Contractor Training

Technical, Guarantee & Warranty Services

Peak Advantage Contractor Portal Login

Find a Distributor

Design Professionals

Design Professional Services

Specification and Design Assistance Request

BURSI Continuing Education Program

Nonwovens

Fiberglass Mat for:

Bituminous Roofing

Carpet Tiles

Ceiling Tiles

Gypsum Boards

LVT Flooring

Mineral and Foam Insulation

Resilient Flooring

Roof Decks

Roofing Shingles

Polyester Nonwoven for:

Battery Products

Bituminous Roofing

Carpet Tiles

Filtration Products

Filtration Products

Air Filtration

Air Pollution Control

HEPA/ULPA

HVAC

Industrial Filtration

Liquid Filtration

Coolant Oil

Industrial Filtration

Reinforcement Fiberglass

Chopped Fiberglass for:

Gypsum Boards

Polyamides (PA)

Polyolefins (PP, PE)

Single-End Roving for:

Long Fiber Thermoplastics (LFT, D-LFT)

Structural Thermoplastics

Thermoset Composites

Multi-End Roving for:

Sheet Moulding Compound

Thermoset Composites

Beneficial Tax Credits for New Homes and Upgrades

Proper insulation is essential in creating an efficient and comfortable home. The good news is that through the Inflation Reduction Act, there are tax credits for both new homes and upgrades to existing homes, and those tax credits can benefit everyone including contractors.

45L: HOMEBUILDER Tax Credits

The Inflation Reduction Act includes much-needed improvements and extensions to federal tax credits for home energy efficiency. There are credits for new home construction. It’s simple for a builder to take advantage of these energy tax credits, and with the help of Johns Manville insulation products, you can make the most of this opportunity.

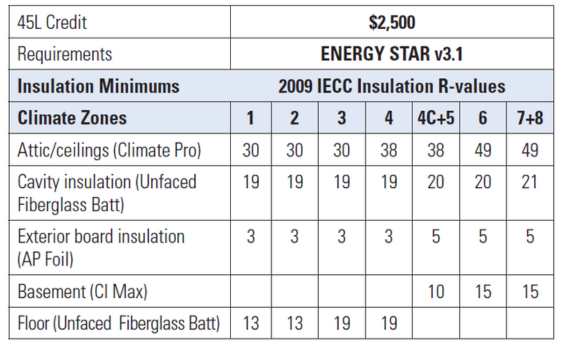

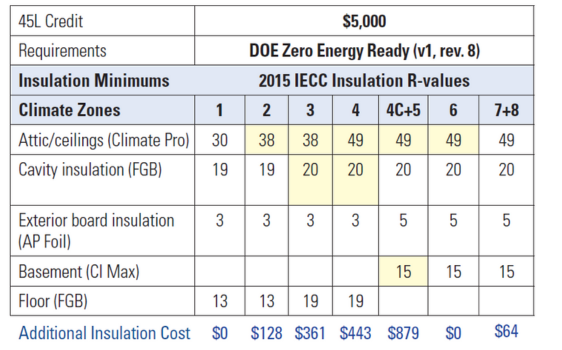

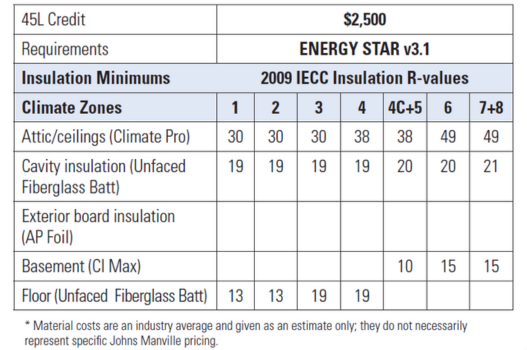

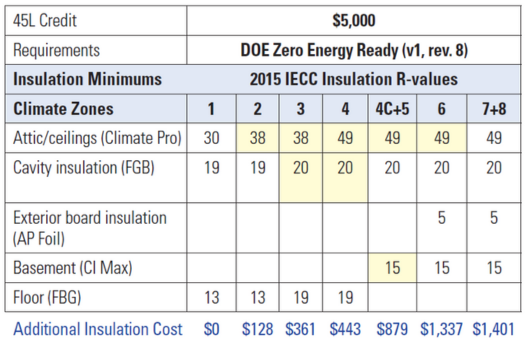

Surprisingly, the differences in insulation material costs for the $2,500 tax credit vs. the $5,000 credit for new builds are minimal, even none in some climate zones.

Three Bedroom 2,200 SF Home, 2x6 framed

Check out the following charts for insulation material costs across climate zones and for different sections of a typical 3-bedroom home.

HIGHLIGHTED CELLS state the difference from ENERGY STAR v3.1 to Certified DOE Zero Energy Ready.

Three Bedroom 2,200 SF 2X6 Advanced Frame Home

Saved Documents

Download Options

Choose how you would like to package your saved documents.